K-Electric is the only vertically integrated power utility in Pakistan. It produces electricity from its own generation units with installed capacity of 1875 MW and in addition, has arrangements with external power producers for around 1680 MW which include 1100 MW from the National Grid.

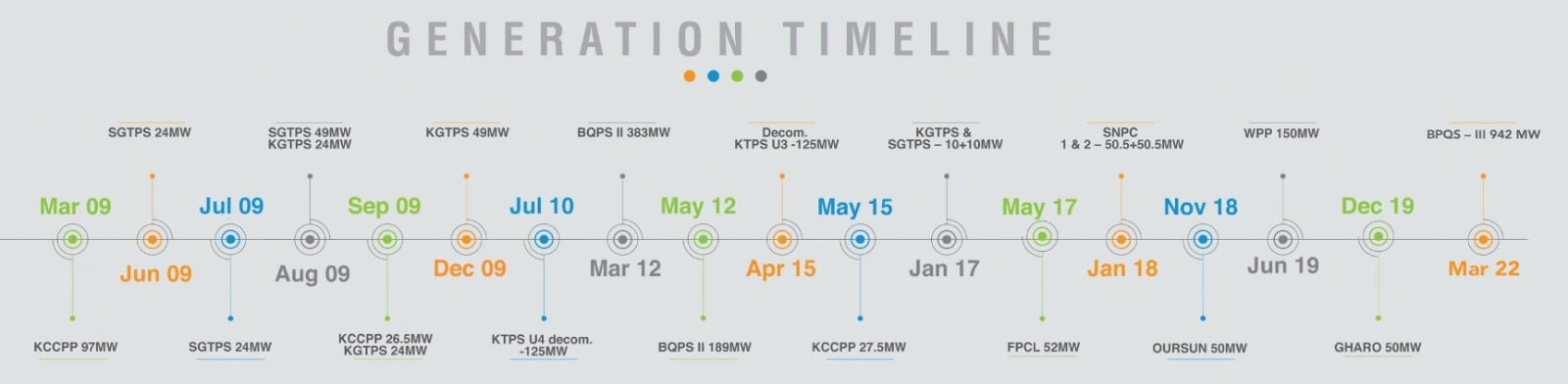

Generation Capacity Enhancement

Through investments of over USD 4.1 Billion in Generation business, KE has enhanced its generation capacity by more than 1,900 MW since 2009 by installing new plants:

573 MW Combined Cycle

BQPS-II

3 x GE Frame 9E Gas Turbines & 1 Harbin Steam Turbine

248 MW Combined Cycle

KCCPP

4 x GE LM 6000 Gas Turbines & 2 x GE Steam Turbines

215 MW Combined Cycle

KGPTS & SGTPS

32 x GE JENBACHER Gas Engines & 1 x NG Allen Steam Turbine each

942 MW Combine Cycle

BQPS – III

2 x SIEMENS Gas Turbine / Steam Turbines each 471.16 MW

Model : Gas Turbine – SGT5-4000F, Steam Turbine – SST5-3000

(KE Own fleet capacities are based on ISO conditions)

Additionally, 52MW and 104 MW added to Fleet through commissioning of FPCL Coal Plant and Sindh Nooriabad Power Company Gas Plant IPP respectively. Moreover, 50 MW each of solar power generation was added through Oursun Solar and Gharo Solar. 14MW added through Lotte RLNG based Captive Power Plant

(KE Own fleet capacities are based on ISO conditions)

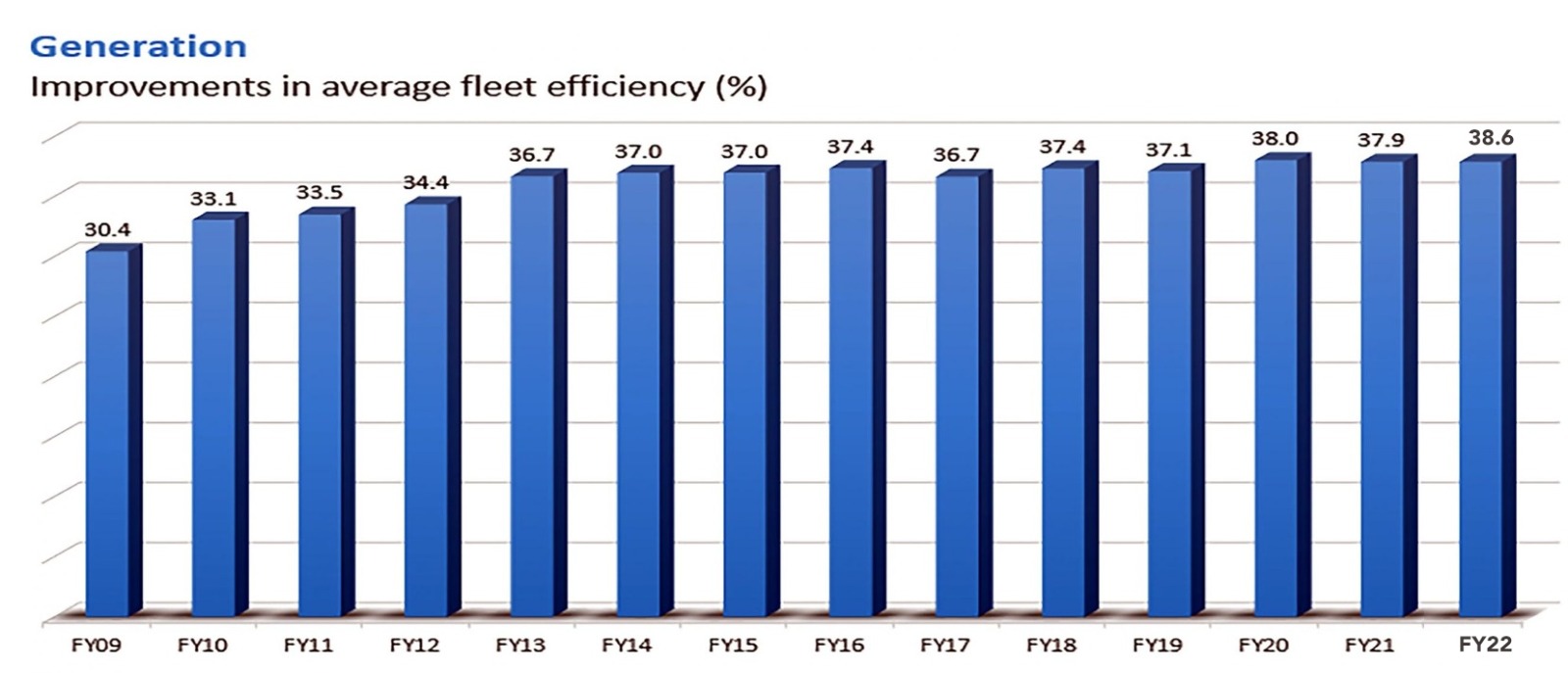

Improvement in Fleet Efficiency: 25%

(Gross HHV)

(Gross HHV)- Average fleet efficiency improved from 30.4% to 38.6% (FY-09 vs. FY-22)

- 70% capacity is less than around 15 years old

- All Gas Engines/Gas Turbine Plants in KE are now in Combined Cycle Operation

Future Projects

To meet the growing industrial, commercial, and residential demand in the metropolitan city of Karachi, K-Electric continues to expand its generation portfolio both through own generation and IPPs.

900 MW BQPS III Power Project

KE is constructing a state of the art 900 MW brown field project for an RLNG-based power plant at Bin Qasim site, along with associated grid expansion projects. This will supplement the power needs of Karachi and add value to the economy through availability of reliable and sustainable power for business and industry. The combined cycle project consists of 2 Siemens Gas Turbines (SGT5-4000F) and Steam Turbines having a rated HHV Net efficiency of 53.85% each. The project also includes upgradation of associated transmission infrastructure. Allocation of 150 MMCFD of RLNG supply has already been endorsed by the Cabinet Committee of Energy and accordingly the Gas Sale Agreement (GSA) between PLL and KE has been signed. On the other hand, construction of the gas infrastructure including 2km pipeline and measuring station has been completed and commissioned to transport RLNG to BQPS III. The project is in advance stage of construction and the commissioning of first unit of 450 MW as combined cycle is expected to be completed in the 4th quarter of FY 2022.

2,050 MW Power from National Transmission and Dispatch Company (NTDC)

KE is pursuing additional 1,400 MW supply from national grid by constructing two new interconnections i.e., 500kV KKI and 220kV Dhabeji grids. In this regard, the contractual modalities with NTDC and CPPA have been agreed and are currently awaiting CCoE approval. Furthermore, supply of 450 MW has already started in CY 2021 under the phased approach, whereas the complete 1,400 MW shall be made available to KE by CY 2023.

150 MW Vindar Uthal Bela (VUB) Solar Power Project

KE is engaged in seeking potential partners and sponsors to promote technological development, construction, operation and maintenance of solar and wind power plants within its franchise area under IPP regime. In this regard, the Company has initiated development of 50 MW projects, each in Tehsil Vindar, Uthal and Bela of Baluchistan region through the Competitive Bidding Process under the NEPRA regulations. Currently, the Request for Proposal (RFP) of the projects is currently under NEPRA approval stage and land allocation for the project sites is underway with GoB. The project is expected to achieve COD by FY 2024-25.

350 MW Sindh Solar Project (SSEP)

KE is planning to develop a 350 MW Sindh Solar Energy Project (SSEP), which is a collaboration between SED, Government of Sindh, and the World Bank. The objective of SSEP is to increase solar power generation and access to electricity in Sindh Province. This tri-partite collaboration is expected to result in additional 700 GWh of clean energy to KE’s total supply, while off-setting carbon emissions by 300-350 kilotons per annum. The Project is currently under internal land assessment phase to finalize site areas for these projects, subsequent to which parties will commence feasibility studies. The Project is expected to commence operations in FY 2025.

330 MW Siddiqsons Energy Limited (SEL)

On December 20, 2021, KE also signed a Memorandum of Understanding (MoU) with Siddiqsons Energy Limited (SEL), for procurement of power from its 330 MW coal-fired plant. Subsequently, KE will be entering into a Power Purchase Agreement (PPA) with SEL; with the Project expected to achieve commissioning by FY 2026. This Project also marks a strategic move for KE’s overall generation cost, which is expected to benefit from cost savings with shift towards indigenous coal.