KE – Pre & Post Privatization

- From a troubled utility having sustained years of losses along with old and....

Customer Centricity at the Core of KE’s Turnaround

- Having customer centricity at the core of its business model, KE has been....

HR Initiatives

- Enhanced workforce effectiveness through creation of a performance-driven culture....

Key Achievements

- Along side operational improvements and technological advancements, enhanced workforce ....

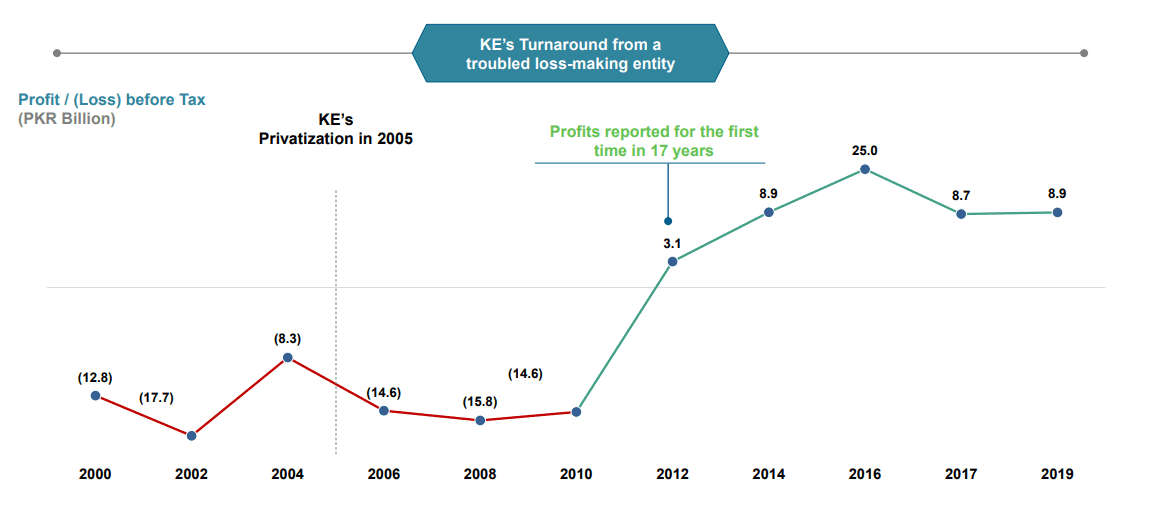

KE’s Turnaround

Case of XWDISCOs’ Privatization

Driven by continued investments across the value chain along with strategic initiatives & processes to unlock value, KE’s turnaround has set a precedent in the local power sector

Validates Case of XWDISCOs’ Privatization

| During FY 1998 to FY 2005, the Company incurred loss before taxes of c. PKR 12 Billion (on average basis) annually – total losses of c. PKR 95.4 Billion during the period |

| To keep the operations afloat, GoP had to provide operational subsidy of c. PKR 28.5 Billion to KE during FY 2003 to FY 2005 |

| Had KE not been privatized, would have continued on loss-making trajectory, burdening the GoP in the form of operational subsidy |

| KE’s improvement in AT&C losses of 18.1% points (Annual impact of c. PKR 60 Billion1) – government would have lost in the form of operational subsidy and losses |

1. FY 19 sent out x 18.1% x Average Tariff

KE’s Turnaround – Impact of Privatization

Continued investments across the value chain along with process improvements not only benefited KE’s consumers, but also had a positive impact on the overall economy at large

-

Savings of over PKR 700 Billion(since 2009) to National Exchequer

Had KE not improved operationally, this would have resulted in operational losses of over PKR 700 Billion(since 2009) – directly impacting the GoP in the form of operational subsidy

-

Industrial Growth and Impact of around 0.5% to 0.7% on national GDP

100% LS exemption to industries since 2010 – had KE not made operational improvements achieved in last 10 years, this would have resulted in additional load-shed, including industries, having an impact of c. 0.5% to 0.7% on national GDP (annual impact of upto c. PKR 200 Billion)

-

Improved Human Development Index / Socio Economic Indicators

Direct positive impact of greater access to power along with over 70% of the service territory being exempt from load-shed, including strategic installations such as hospitals etc – Electricity development index is strongly correlated with HDI

Complexities of Operating in Karachi

Despite operating in a significantly more challenging operational environment, KE’s operational improvements including T&D and AT&C losses have outperformed state-owned DISCOs

With more than 50% of the population living in slums and highest poverty rate among developed cities in the country, Karachi presents unique set of challenges

Indicator |

Karachi |

Islamabad |

Lahore |

Slum Population |

>50% |

10% |

30% |

Poverty Rate |

5% |

3% |

4% |

Per Capita Income |

56,000 |

70,000 |

60,000 |

Livability Index |

202 |

193 |

199 |

Not only is Karachi intricate in its dynamics and operating environment, there are other key challenges which impact execution of planned initiatives in a timely manner and bring other operational improvements

-

Lack of coordination / alignment among Federal, Provincial and Local government and compliance with policies / procedures of different cantonment bodies

-

Right of Way Issues / Approvals – impact timely execution of planned initiatives

-

Lack of standard urban development protocols

Source: Mercer, State of Pakistan Cities report 2018 (UN-Habitat), State of Industry Reports, News Reports

Conclusion

Drawing upon KE’s experience, privatization of state-owned entities is critical to ensure sector sustainability going forward as well as make them self reliant which would thereafter help make targeted and focused investments resulting in improved service levels – important that Government prioritizes the same

Way Forward

-

Regulatory reforms to remove bottlenecks including cross subsidy model, lack of a cost reflective tariff regime, and provide a sustainable framework to a Multi-Buyer Model balancing interest of all stakeholders – reduce the role of the government

-

Reduction in T&D loss through replacing obsolete infrastructure, modern tools, data analytics / big data / technology

-

Improvement in Recovery – through use of technology / data analytics identification of consumer

-

Incentivize industries to use grid rather than captive to dilute impact of capacity payments

-

Terminate expensive fuel and inefficient contracts

-

Privatize DISCOs / consider public private partnership

-

Convert circular debt to public debt – it is public debt anyway

-

Enhance capacity of NEPRA – independent impact assessment

-

Learn from success stories like KE, Gujrat, Delhi Models

-

Timely tariff announcements/adjustments

-

Make a small team / task force to develop roadmap for reforms & policy changes urgently:

-

Consider recent NEPRA State of Industry Report

-

Power Sector Committee Report

-

Engage with stakeholders / experts

-

Study other good practices