Multi-Year Tariff (MYT)

Delays in tariff determinations and lack of cost reflective tariff not adequately compensating for actual cost of business impacts the ability to make required investments, ultimately compromising consumer interests

-

Delays in Tariff Finalization

KE’s Multi-Year Tariff (MYT) finalization took almost 3 years

-

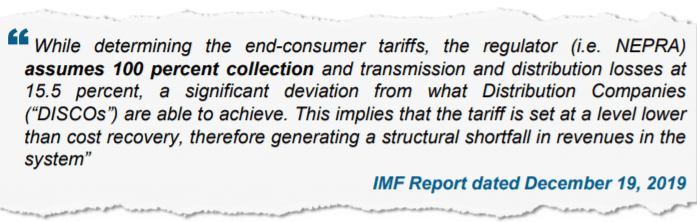

Lack of Cost Reflective Tariff

Recovery loss, a critical cost component to be compensated through write-offs in KE’s MYT – however, despite fulfilling the required criteria, there are delays in processing of these claims by NEPRA

-

Impact on Planned Investments

Delays and uncertainty around tariff resulted in delayed investments in KE’s power infrastructure including the 900 MW BQPS III RLNG based power plant

-

Mid-Term Review

KE has filed for certain adjustments to enable it to execute planned investments in a timely manner – critical that NEPRA processes the same in an expedient manner

-

Impact of COVID-19

Significant impact on operational and financial indicators – important that the government and regulator devise a plan / strategy to compensate distribution companies

Impact of COVID-19

The fall out of COVID-19 and measures including lockdown and deferment of electricity bills are likely to have a significant impact on the power sector, particularly distribution companies – estimated annual impact is c. PKR 500 Billion

Non-Operational (c. PKR 300 Billion)

-

Change in consumption mix due to lockdown – adverse mix

-

Increase in fixed costs / capacity costs due to increased under / nonutilization of plants

-

Delays in determinations for tariff variations / adjustments

Operational (c. PKR 200 Billion1)

-

Reduction in units sent-out due to reduced power demand

-

Adverse sent-out mix and change in consumption pattern – increase in T&D losses

-

Reduced recoveries and financial impact of deferred recoveries

What needs to be Done?

-

Adjustments in tariff should be allowed by NEPRA

-

Compensation for compliance of government directives

-

Package for vulnerable domestic segments

Source: CPPA-G

KE’s Planned Projects & Demand Supply Outlook

To ensure continued investments across the value chain, it is critical that payment of outstanding dues including TDC and other government receivables is made at the earliest

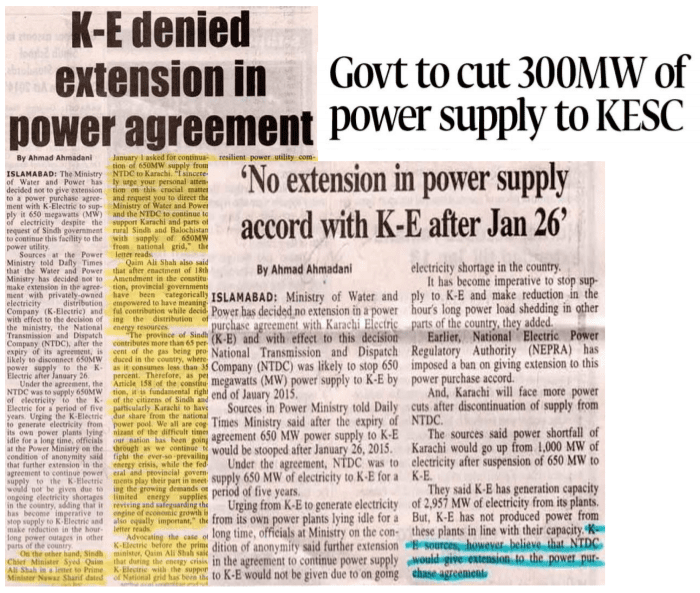

Uncertainty around supply from National Grid

KE had to plan for its own power projects to meet Karachi’s growing power demand

Robust Investment Plan including 900 MW RLNG and 700 MW Coal Project

Significant time and resources committed to key planned projects, including 700 MW Coal Project

Delays in approvals of 700 MW Project

Despite lapse of over 3 years, tariff for 700 MW approved by NEPRA is pending notification with Power Division and has thus adversely impacted project timelines

Projected Shortfall in KE’s service area

Due to delays in approvals, there may be a shortfall of around 1,400 MW in KE’s service area in FY 2023

KE being asked to absorb surplus capacity in the National Grid

Due to fragmented planning at national level, there is now surplus capacity and further additions of around 20,000 MW have been committed till 2027

KE’s Receivables from Government Entities

To ensure continued investments across the value chain, it is critical that payment of outstanding dues including TDC and other government receivables is made at the earliest

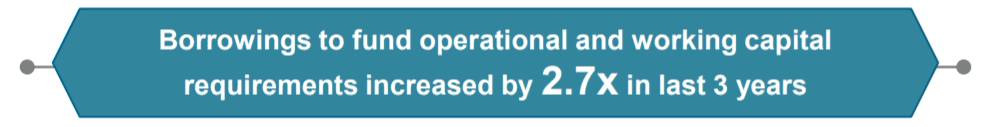

Continuous accumulation in receivables from government entities / departments has resulted in KE’s borrowings to fund operational and working capital requirements reach unsustainable levels

1. FY 2020 balance does not include claims for June 2020, however, includes TDC release received in June 2020