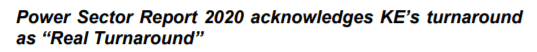

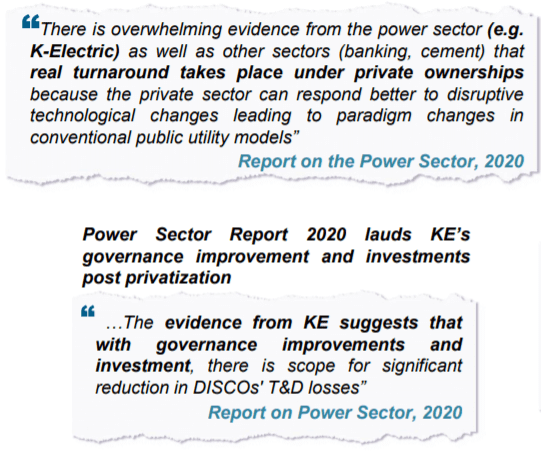

KE’s Turnaround – An example for State-owned Entities

KE’s transformational turnaround success has been acknowledged at various forums – both locally and internationally

Myths about KE

Myth

Reality

- 1,057 MW added since 2009 and planned projects delayed due to delay in tariff – would have taken KE into surplus

- KE ready to pursue 700 MW project on local coal – tariff notification on hold by GoP, while around 1,500 MW of similar coal projects are being added in the National Grid in the next 4 to 5 years

- Planned additions would have also helped phase away from expensive sources resulting in reduction in tariff – KE to absorb idle capacity available in the National Grid instead of its planned projects

- Despite GoP and SSGC commitment of 276 MMCFD indigenous gas, allocated quantity not being supplied

- Gas supplied to KE is on comingled basis including RLNG at distribution tariff – expensive fuel

- Around 200 MMCFD1 gas from SSGC system being diverted to inefficient captive plants

- Tariff charged to consumers is as per GoP’s Uniform Tariff Policy

- Under the existing regime, GoP has a cross subsidization model where high-end consumers cross subsidize lowend consumers – DISCOs including KE have no role in tariff setting

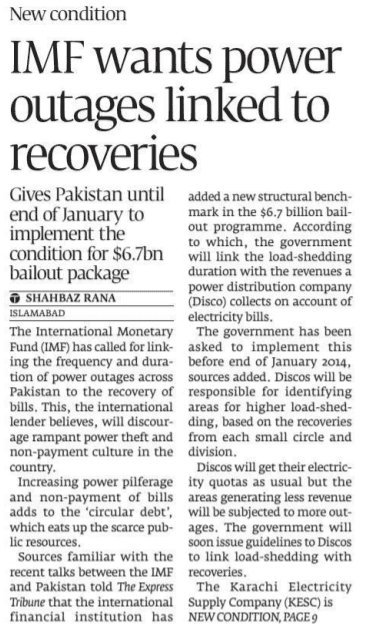

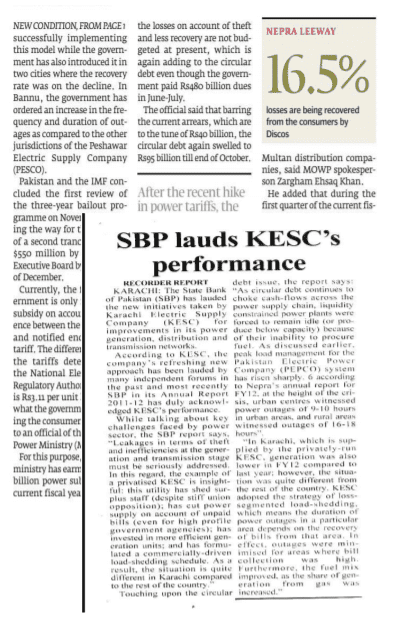

- Segmented load-shed has inspired a mindset shift and helped KE reduce losses in high loss areas

- KE’s load-shed policy is in line with GoP’s National Power Policy 2013 and is also practiced by other DISCOs across the country

Source: State of the Regulated Petroleum Industry 2017-18

KE’s Segmented Load-shed Policy – A shift in Mindset